2021 Update

A New Beginning...

2020 was a year to remember and in a lot of cases, a year to forget. While the stock market achieved record highs - in the end, it took a roller coaster of a ride to get there. The equity markets soared 14.2% in the 4th quarter alone as multiple vaccines were introduced to thwart Covid-19, a Presidential election was decided, and expectations of further fiscal stimulus brought some predictability in the economy. Although markets rose to new heights - with technology and growth stocks being the leader(s) - numerous sectors including Energy, Financial Services, Hospitality and Real Estate lagged behind.

What will the new year bring? With the Democratic party taking control of the Senate, House and the seat of the President, it’s yet to be seen what the future will hold. As more vaccines get distributed and the number of people who’ve already been infected with the coronavirus increases, you can see the light at the end of the tunnel regarding pandemic-induced restrictions on economic activity. The eventual return to a normal world, whatever that looks like, will benefit the industries most impacted by Covid-19 in the short-run.

Interest Rates and Bonds - the ‘Boring’ Part of the Portfolio…

We do not expect meaningful increases with interest rates over the next couple of years as the Fed ‘s economic forecasts suggest short-term interest rates will remain close to zero. However, better than anticipated growth and an accelerated re-opening process could eventually lead to higher interest rates.

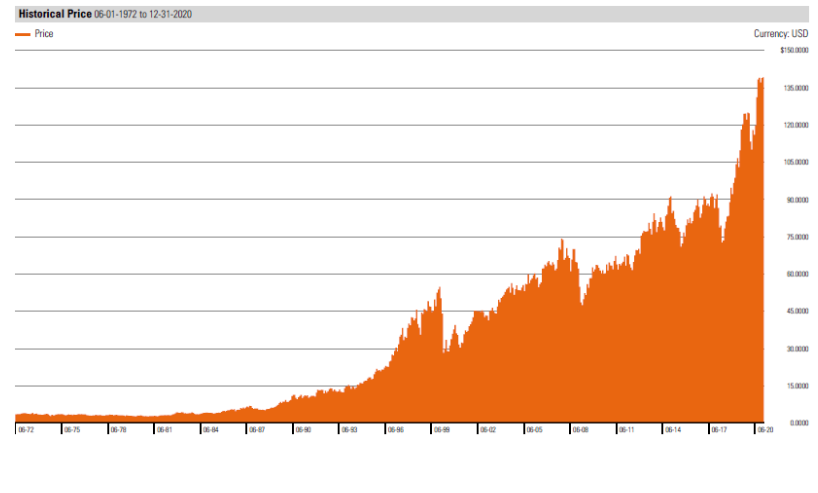

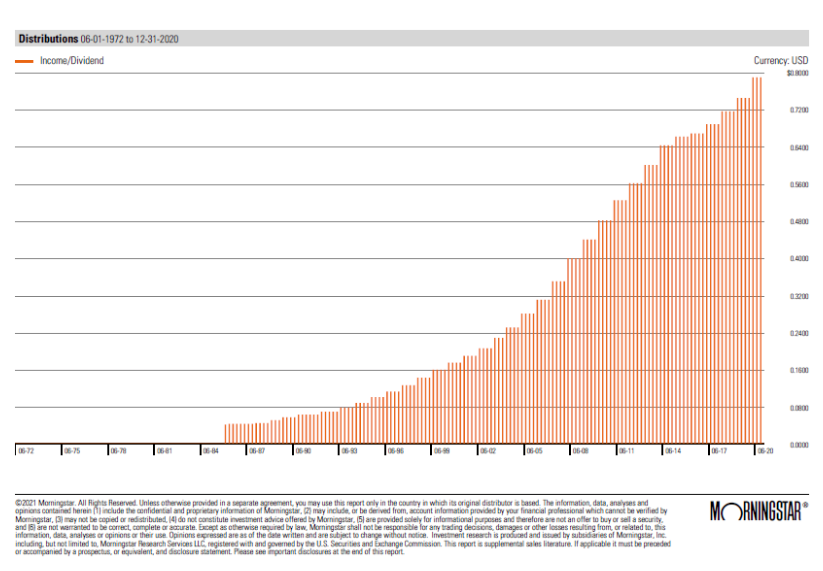

With the above being said, the yield on bank accounts and / or CD’s is noticeably low. It’s natural to search for an alternative and most times this includes dividend paying equities. A prime example is the consumer products behemoth Procter & Gamble (PG). The current yield on PG is 2.46% - which if you earn .25% in a bank account, PG equates to roughly 10x the income received from the bank on an annual basis. All of this considering that PG has increased their payout for 67 consecutive years, and there's an opportunity for principal growth (or loss) when owning the stock. Below is a graphic that stretches from 06/1972 - 06/2020, the top section is the share price of PG and the bottom section illustrates the dividends that were paid in the same time period. Each line represents a separate dividend payment. Clearly, regardless of stock price moving up or down the dividends are consistent and increase annually.

The GameStop / Reddit Circus....

Lastly, we’d be remiss - because of the timing of this - not to mention the insanity of GameStop. It’s finally hitting the mainstream news cycle, but we aren’t going to place an opinion on it. Rather, below is a link to an article explaining the situation...simplified.

CNBC GameStop Explanation

Moving Forward...

If 2020 taught us anything (and we assume you’d agree it taught us a lot), is that the market focuses on the future and not necessarily what is happening today. One of the tragedies of the pandemic is the disproportionate impact it had on small businesses compared to large, publicly traded companies. While most portfolios benefited from this occurrence, those small to medium size businesses need our support. Our hope is that 2021 will bring health, less divisiveness and the ability for small businesses to function at a level they need to be successful.