Where Do We Go From Here?

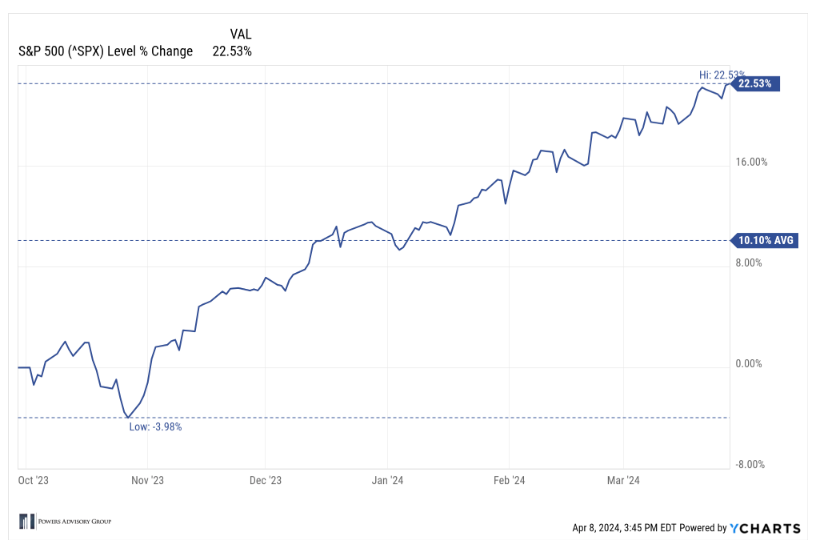

In recent weeks, we’ve been asked several times about how to invest given the significant climb in the stock market over the last 5 months. Let’s look back at the recent quarter performance as well as the overall market performance since the October 2023 lows…

The S&P 500 registered a gain of 10.6% in the first 3 months of 2024. This followed historically strong performance in November and December and from its low in October to the end of Q1, the S&P 500 rose an impressive 28%. Year-to-date alone, the S&P 500 has reached a record closing high on 22 separate occasions.

It's interesting how when the stock market hits record highs or experiences downturns, it triggers mixed emotions known as behavioral finance. Investors tend to feel happy seeing their account balances rise during highs, yet fear the possibility of a downturn. Consequently, they become cautious with new investments. Similarly, during market downturns, investors feel anxious about investing more, fearing further declines. Despite the opportunity to buy stocks at lower prices, seeing their account balances decrease often makes them hesitant.

Should this rally suggest caution or concern?

During periods like this, it's wise to examine historical market trends following significant short-term gains. Over the past 50 years, whenever the S&P 500 has surged at least 25% in a 100-day span, it has typically risen another 15% on average over the next 12 months (Bloomberg Finance). Remarkably, in 98% of these instances, the index generated positive returns. While past performance doesn't guarantee future results, this track record is compelling. This year, the performance of the S&P 500 has started to diversify beyond the "Magnificent 7." In 2023, these top stocks contributed 60% to the index's gains, while the remaining 493 stocks only accounted for 40%. However, so far this year, these percentages have flipped.

Despite the market's impressive gains of over 20% in a year, we actually saw an earnings recession from late 2022 to the middle of 2023. However, earnings of the S&P 500 began improving in the middle of 2023 and reported year-over-year growth in Q3 2023 for the first time in a year. In Q4 of 2023, S&P 500 earnings increased by 4% compared to the prior year, showing continued improvement. This trend is set to continue as the S&P 500 is poised for its third consecutive quarter of year-over-year earnings growth in Q1 2024. Although earnings have rebounded, they still heavily favor the top 10 companies, mostly in the Technology and Communications Services sectors. Nevertheless, earnings are now starting to spread across various sectors.

FactSet predicts S&P 500 earnings to grow by close to 11% in 2024, a significant improvement from the 1% growth seen in 2023. Sectors like Healthcare, Materials, and Energy were major drags on earnings in 2023 but are expected to see substantial improvement in 2024. Interestingly, these sectors led the market surge in March.

At the beginning of 2024, many expected interest rate cuts to support market performance. However, despite the Federal Reserve maintaining interest rates, significant rate cuts for the remainder of the year are unlikely. While more rate cuts were anticipated, this isn't necessarily negative. The resilience of the US economy against higher rates and inflation has allowed rates to remain higher for longer. Moreover, market gains seem to be driven more by improving corporate fundamentals than by the Fed slashing interest rates, which is viewed positively.

Given the improved corporate earnings outlook, potential for rate cuts, and broader participation in the S&P 500, our overall perspective remains optimistic. However, we still anticipate some natural market volatility. Historically, there has been an average of one market correction (10% downturn) every other year. Additionally, pullbacks of 5% or more by the S&P 500 are more common, typically occurring a few times each year. While the timing of these events is unpredictable, they should not necessarily come as a surprise. Maintaining a disciplined asset allocation, focused on long-term goals helps navigate the unpredictable nature of financial markets.

As always, if you have questions or concerns about your individual situation, please don’t hesitate to contact us.