Tune Out the Noise

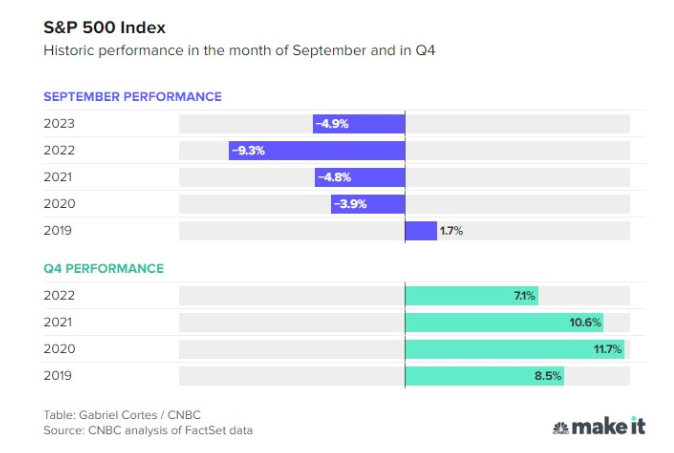

As we enter the early stages of the fourth quarter of the year, the month of September reared its ugly head again in the markets. Historically, September has been the worst month of the year for stock market performance and this year was no exception. Going back to 2019, the S&P 500 Index posted losses in 4 of the last 5 Septembers. Looking back even further, September has been the worst performing month of the year - on average - for the S&P 500 since 1950.

That’s the “bad news”...now comes the “good news”...

Each year since 2019, the S&P 500 Index reported healthy gains during the 4th quarter. Since 1950, stocks have gone up in the 4th quarter almost 80% of the time - the highest success rate of any quarter.

After month’s like September, we often get questions from clients asking if we should make any changes. We usually respond with a couple of (really important) questions of our own:

Have your goals changed?

Has your risk tolerance changed?

If the answer is “Yes”, then changes to the investment portfolio are typically recommended. On the other hand, if the answer is “No’”, significant changes are often detrimental to overall investment goals. These are more along the lines of emotional changes, as opposed to fundamental / objective decisions.

Will the 4th quarter of 2023 follow historical trends? No one knows for sure. There are numerous challenges that create volatility in the market such as - higher-for-longer (buzz word of the moment) interest rates, the wars in Israel and Ukraine, and energy prices and labor strikes…let’s not forget political dysfunction in Washington. Even good news, such as the latest jobs report in September that the US economy added a robust 336,000 new jobs compared with estimates of 170,000 jobs, can be viewed in a negative lens. While good for the economy, it’s not exactly what the Fed wants in terms of keeping inflation in check.

All that said, times of volatility and uncertainty provide long-term opportunities. Even though the fixed income market has been ugly of late, the future of it looks very appealing from a total return perspective (coupon payments plus the potential for price appreciation). While the “Magnificent Seven” - Tesla, Apple, Meta, Amazon, Nvidia, Microsoft and Alphabet- have generated most of the markets’ gains this year, the vast majority of stocks in the S&P 500 are struggling. If the S&P 500 was equally weighted amongst the 500 stocks, it would actually be down for the year as of the end of September. While this year looks great for those 7 stocks, no one was calling them “Magnificent” in 2022, when they were down an average of 40%. The relative struggles of those outside the “Magnificent Seven” are creating opportunities for patient investors in certain sectors of the market. Utilities are trading at their lowest price-to-earnings multiple since exiting the 2008-2009 recession. Real Estate Investment Trusts, Financial, Consumer Staples and Industrial sector stocks all hold promise in the long-term. Things can change quickly and it is best not to get caught up in all the headlines and noise.

As always, if you have questions or concerns about your individual situation, please don’t hesitate to contact us.