Is Facebook Growing Up?

While most know “Facebook” by its given name, it trades as a stock under the name “Meta”. Years after changing its corporate name to Meta, it still resonates as Facebook to us and likely most of you reading this post. As we write this, Meta’s stock is surging for a few reasons - big earnings beat, share buybacks, and most importantly it announced that it will pay a quarterly dividend for the first time as it approaches its 20th anniversary. The $2.00 annualized dividend represents a yield of 0.40% based on the current price of $472 a share as of this morning’s stock price. Compared to the current yield of 1.47% for the S&P 500, Meta’s payout would be considered relatively low by industry standards.

Why start paying a dividend now? Let’s go back to 2022, where Meta’s stock was down a staggering -63.31% for the year. Interest rates rose at a historical pace, causing growth stocks such as Meta along with broader equity markets to sink. It wasn’t just macro pressures that caused the stock to fall - many in the investment community questioned Meta’s piling tens of billions of dollars into the virtual reality portion of the company. Additionally, their founder, Mark Zuckerberg, has never really been considered a sympathetic figure. Like him or not, he’s taken the company to heights most thought to be unattainable. As Meta faced more scrutiny from a business perspective, they were challenged to make changes. While some of the spending questions still exist to this day, they’ve made significant strides in the operational efficiency of the company.

Large tech companies are not known for their capital discipline but more often for lavish employee perks and “pet projects”. 2022 forced Meta, along with other tech companies, to rethink some of these business strategies. Zuckerberg called 2023, “the year of efficiency”. This meant spending less on infrastructure, removing layers of management and killing dead-end projects. Specifically, Meta reduced their employee headcount by 22% in 2023. They were not the only ones to do so, as Amazon, Alphabet and Microsoft each announced plans to layoff over 10,000 employees in late 2022 and early 2023.

So back to the original question - why the dividend? With this increased financial accountability, comes higher profits and increased free cash flow. With a market cap of $1.2 trillion, Meta’s cash in the business has leaped year-over-year from $40.7 billion to $65.4 Billion. In other words, Meta is becoming a “grown-up” in the eyes of shareholders.

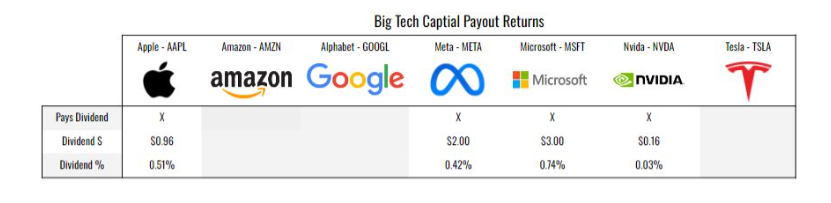

Meta’s peers in the “Mega-Cap Tech” area playout like this:

Microsoft declared its first dividend in 2003 and has grown the payout +11.8% on average per year over the last decade. Apple restarted their dividend payment in 2013 that has grown over 8% per year. Alphabet (Google), Amazon, and Tesla don’t pay a dividend. Nvidia’s dividend barely qualifies as a payout with a .03% yield, which is to be expected - free cash flow needs to be normalized following the demand in AI before a dividend is its focus.

It’s yet to be seen where the recent (albeit rare for high growth technology) dividend payment will lead. For now, we’re happy to see them join the crowd of companies that have committed to reward shareholders with a quarterly payout…and hope others follow suit.

As always, if you have questions or concerns about your individual situation, please don’t hesitate to contact us.