By Matt Powers

•

January 5, 2026

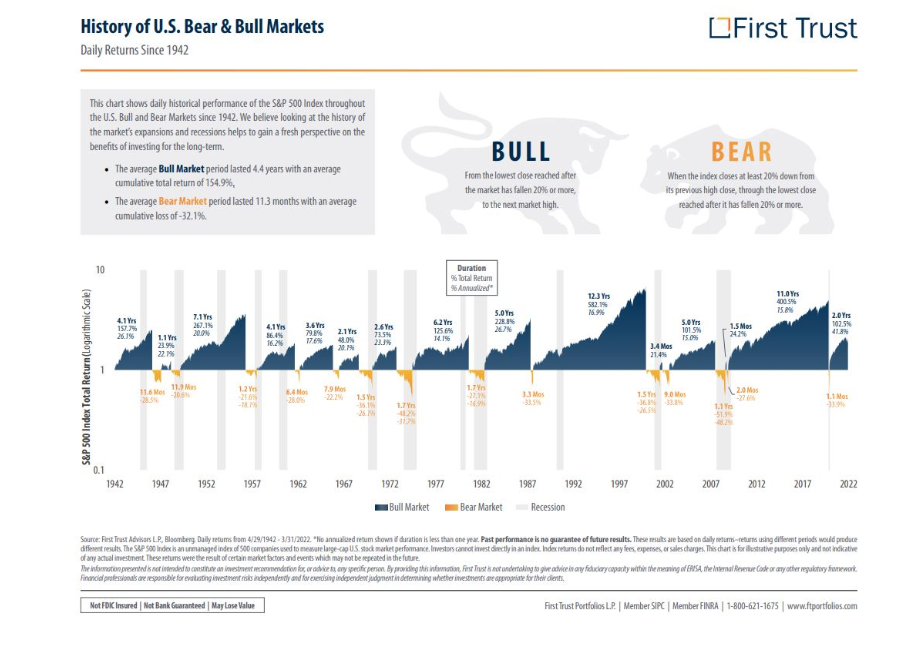

How 2025 Wrapped Up, And What We’re Watching Next We hope everyone had a great New Year and is off to a productive start to 2026! Below is our outlook on the year, along with some other housekeeping items… As 2025 came to a close, markets showed a little hesitation right at the finish line. The final trading sessions were mildly lower, and we didn’t get the classic year-end “Santa Claus rally” many investors look for. But zoom out, and the bigger picture was still very positive. The S&P 500 finished the year up roughly 16%, marking its third straight year of double-digit gains. That puts this run among the stronger multi-year stretches we’ve seen in quite some time. So even though things felt choppy at the end, investors who stayed focused on fundamentals were rewarded. Tech and AI-related names drove much of the upside early, but as the year went on, participation broadened and more cyclical areas joined the rally. That’s a theme worth carrying into 2026. Summarizing 2025 is easy: Markets delivered strong returns, earnings held up, and the economy avoided the slowdown many feared. The more interesting question looking ahead is this: Can the market repeat it, and what actually has to change under the surface for that to happen? History tells us markets can keep going, but rarely in the same way. That idea shapes how we’re thinking about the year ahead. Theme #1: Returns Likely Moderate and That’s Normal After several strong years, moderation is often the next phase. A few reminders from history: We’ve had a bull market in every decade for the past 100 years Nearly half of bull markets make it into a fourth year Fewer than 40% post strong gains in that fourth year Pullbacks of 10–15% are common even in healthy bull markets In other words, slower returns and occasional drawdowns are often the cost of extending a bull market. For 2026, returns are likely to be more earned, more selective, and more dependent on fundamentals and not broad multiple expansion. Theme #2: Leadership Will Change Leadership is how bull markets survive. Historically, about three-quarters of bull markets see leadership shift after the first three years. That shift usually extends the cycle rather than ending it. We’re seeing signs of that already: More sectors gaining traction Less reliance on a small group of mega-cap names Improving participation across healthcare, industrials, materials, and other cyclical areas This kind of rotation is healthy. It refreshes the market and creates new opportunities beyond the higher valuation areas. Theme #3: Volatility Picks Up As market transition phases, volatility usually follows. Why? Valuations are higher, leaving less room for disappointment Policy headlines and macro noise aren’t going away Expectations reset, which leads to sharper short-term swings Two additional factors matter in 2026: Midterm elections . Historically, midterm election years tend to bring more volatility as markets price in uncertainty around fiscal policy, taxes, regulation, and government spending. While outcomes often resolve positively over time, the path there is rarely smooth. High earnings expectations. When expectations are elevated, even “good” results can lead to pullbacks if companies miss slightly or guide conservatively. What Still Supports a Constructive 2026 Even with moderation and volatility, the foundation is still solid: Earnings remain the anchor Participation continues to broaden Rate pressure is no longer tightening - the Fed is now more of a tailwind than a headwind Margins and profitability are improving, helped by productivity gains The Economy: Slowing, Not Stalling Economic data in 2025 quietly surprised to the upside. Growth held up even as the labor market cooled. Unemployment levels moved higher but remained consistent with a slowing economy and not one of the verge of recession. The biggest story was and still is productivity. Companies continued to grow profits even as hiring slowed. That productivity backdrop helped support margins and earnings and is a key reason the economic foundation remains intact. The argument can be made that this is the AI effect. Where AI Fits Now AI is still a major investment theme, but the market’s focus is evolving. Capital spending topped $400 billion in 2025 and could approach $600 billion next year, largely tied to infrastructure and data centers. The shift now is this: The market is less interested in who is spending and more interested in who is benefiting. Moving from builders to adopters, simply companies that can translate AI investment into productivity, margin expansion, and real earnings growth. Venezuela We’re all aware of the capture of Venezuelan President Nicolas Maduro…an event that has broad geopolitical ramifications. Venezuela currently has the largest proven oil reserves in the world. The practical reality is that Venezuela currently produces a fraction of its potential because of years of underinvestment, sanctions, and infrastructure decay. Bringing production back online will take billions of dollars and years of work, it’s not an overnight fix or like turning on a faucet. Near term, expect some choppiness in oil as headlines drive volatility. Longer term, if Venezuelan production actually makes it back into global markets, it could shift supply and benefit U.S. energy players. Either way, geopolitics stays part of the backdrop for both commodities and equities. Retirement Contribution Limits Have Changed 401(k), 403(b), and most 457(b) plans: Contribution limit rises to $24,500 in 2026 (up from $23,500). IRA (Traditional & Roth): Annual contribution limit increases to $7,500 (up from $7,000). Catch-up contributions (age 50+): Up to $8,600 (up from $8,000). “Super” catch-up (ages 60–63): Up to $11,250 if your plan allows. We look forward to a great 2026 and navigating the year together. As always, don't hesitate to reach out if you have any questions or concerns.