Predictably Unpredictable

Predictably Unpredictable

While the US stock market indices have enjoyed a spectacular run since April of 2020, we sense the rise has given investors a false sense of security. For a majority of the last 10 years, stock indices - particularly in the US - climbed steadily with minimal pullbacks. As an investor, seeing the bottom line of your monthly/quarterly account statement seemingly climb each time you open it creates the perception of certainty. “Investment experts” provide forecasts and suggest the markets will reach certain levels by a specific time. Are these forecasts and predictions worth the paper they are written on? Our suggestion is that while they can have value and help shape your opinion, oftentimes they meet resistance in the form of unexpected events and circumstances not materializing as predicted. Are the “talking heads” held responsible for their inaccurate predictions? The answer is...no.

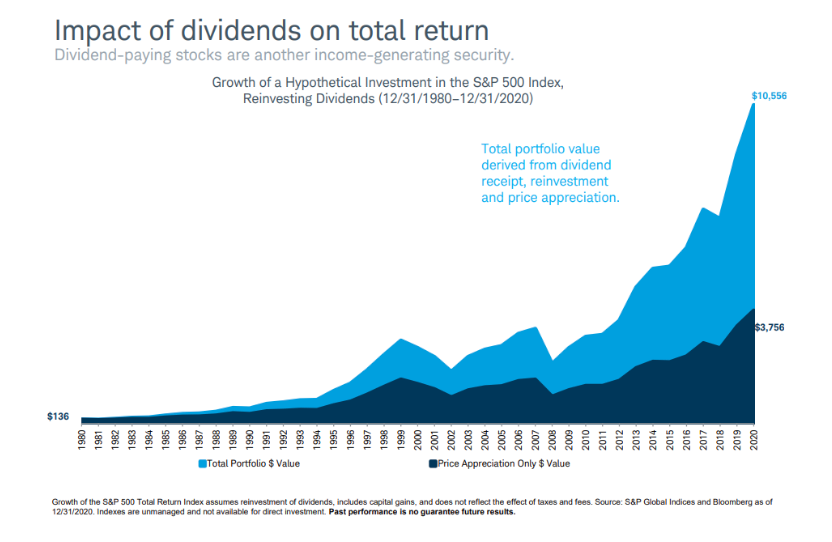

A great example of predictability is currently playing out in the stock market. Going back to 1950, there have only been 2 years where there wasn’t a 5% drop in the S&P 500 throughout the course of the year. Guess what hasn’t happened in 2021? Does this mean it will happen before the end of the year? We don’t know and in the grand scheme of things, it does not change our investment philosophy for our clients. Market adjustments should be expected...but what makes a correction unpredictable is its timing. This does, however, provide the opportunity to re-balance investments and re-invest dividends, in turn accumulating more shares and generating more income - investing’s best friend, compounding. See below:

We're investing, not trading, in terms of years or decades rather than next week or the year-end. It's very easy to get caught up in the news media frenzy, especially when CNBC shows headlines such as ‘The S&P 500 Index recently experienced 5 straight days of losses and the worst weekly performance since’ ----wait for it---- ‘June’. When you invest according to your goals and have reasonable expectations of returns over time, things tend to work out.

As always, never hesitate to reach out with any questions or concerns.